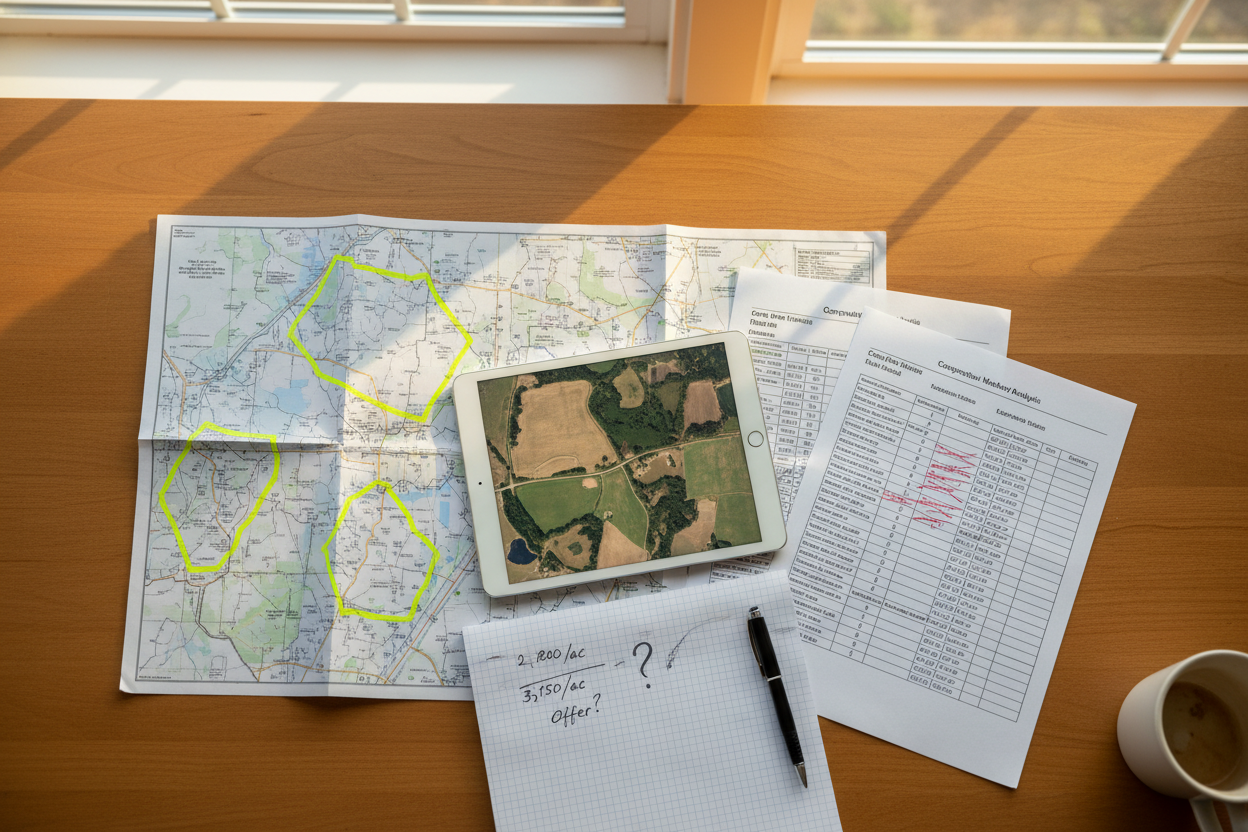

You've got a listing appointment tomorrow. The seller wants to know what their 60 acres is worth. You pull comps and find... nothing. No sales in the area for 18 months. The few that exist are completely different—wrong size, wrong terrain, wrong use case.

Welcome to land brokerage.

Unlike residential real estate, where you can find 10 comparable sales within a mile, land often exists in a data vacuum. And yet, you still need to come up with a number that's defensible, realistic, and gets the property sold.

Here's how experienced land brokers approach it.

Why Traditional Comps Fall Apart

Residential comp analysis works because houses are relatively similar. Three bedrooms, two baths, 1,800 square feet—you can find dozens of those in most markets.

Land doesn't work that way. Every parcel is different. Access varies. Topography varies. Water, timber, minerals, zoning—all of it creates variables that make direct comparison nearly impossible.

And even when you find a sale that looks comparable on paper, you often don't know the story behind it. Was it a distressed sale? A family transfer? Did the buyer overpay because they owned the adjacent parcel? The sale price alone doesn't tell you enough.

This is why "just pull comps" isn't a strategy for land. It's a starting point at best.

The Three-Layer Approach

When comps are thin, experienced brokers build value from multiple angles.

Layer one: Expand your search radius and timeline. If there's nothing within 5 miles, go to 10. If there's nothing in the last 6 months, go back 18 or 24. You're not looking for perfect matches—you're looking for data points that help establish a range. A 100-acre ranch sale 15 miles away still tells you something about what buyers in this region are willing to pay per acre for similar land types.

Layer two: Break down the components. Instead of pricing the parcel as a single unit, analyze what makes it valuable. How many acres are tillable versus wooded? Is there road frontage? Water features? A building site with views? Each component has its own value driver. A 40-acre parcel with 10 acres of prime tillable ground, 25 acres of mature hardwoods, and a 5-acre homesite isn't one product—it's three.

Layer three: Talk to the market. Call other brokers who work the area. Talk to appraisers. Reach out to buyers who've been active recently. The market knows things that MLS data doesn't capture. Someone might tell you that recreational land in that county is hot right now, or that a new development two counties over is pushing demand. This intelligence doesn't show up in spreadsheets.

The Per-Acre Trap

New land brokers often default to per-acre pricing because it feels objective. "Land in this county sells for $5,000 an acre, so 60 acres equals $300,000."

That's lazy math, and it'll cost you listings or leave money on the table.

Per-acre pricing ignores the fact that land value isn't linear. A 10-acre parcel often sells for more per acre than a 100-acre parcel because more buyers can afford it. A parcel with highway frontage commands a premium that has nothing to do with acreage. A landlocked parcel with no legal access might be worth half of what the per-acre average suggests.

Use per-acre numbers as a sanity check, not a pricing strategy. The real work is understanding what makes this specific parcel valuable to a specific type of buyer.

Know Your Buyer Before You Price

Every pricing conversation should start with a question: Who's going to buy this?

A hunting property attracts a different buyer than a development tract. A small homesite parcel sells to a different audience than a working cattle ranch. Each buyer type has different criteria, different budgets, and different tolerance for price.

If you price a recreational tract like farmland, you'll either underprice it or attract the wrong buyers. If you price a rural homesite like a commercial development opportunity, you'll sit on the market for a year wondering why nobody's calling.

Understand the buyer, then price to that buyer.

The Conversation With Your Seller

Sellers want certainty. They want you to tell them exactly what their land is worth and guarantee it'll sell at that price.

You can't do that. But you can walk them through your process.

Explain the comps you found and why they're imperfect. Show them how you analyzed the components of their property. Share what you're hearing from the market. Then give them a range—not a single number—and explain the trade-offs between pricing high and pricing to sell.

Sellers respect brokers who show their work. They don't respect brokers who throw out a number and can't defend it.

Pricing Is a Skill, Not a Formula

There's no algorithm that spits out the right price for land. If there were, sellers wouldn't need brokers.

What separates good land brokers from average ones is the ability to synthesize incomplete information into a defensible opinion of value. That takes market knowledge, analytical thinking, and the confidence to make a call when the data doesn't give you easy answers.

The more you practice it, the better you get. And the better you get, the more listings you win.

Landverse AI Academy teaches the systems and frameworks that help land brokers analyze, price, and market properties faster. Learn more at landverseai.com/academy.